Amid growing interest among foreign investors in the aviation market, Vietnam Airports Corporation and Vietnam Airlines – the two most influential corporations in the aviation sector – will continue to divest large state stakes to fund future development plans.

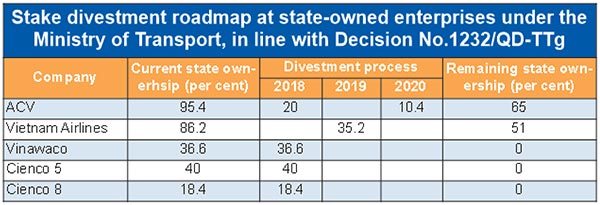

Deputy Prime Minister Vuong Dinh Hue signed Decision No.1232/QD-TTg on August 17, approving the state stake divestment for state-owned enterprises (SOEs) and corporations in 2017-2020, with Vietnam Airports Corporation (ACV) and the flag carrier Vietnam Airlines (VNA) both named among the many in line for divestment.

ACV will have to sell off 20 per cent of its state stake in 2018 and 10.4 per cent in 2019, while VNA will have to sell 35.16 per cent in 2019, thus cutting state ownership in the firms to 65 per cent and 51 per cent, respectively.

“The divestment will be a good chance for foreign investors to join the local aviation market. Many foreign investors are interested in acquiring stake in the firms,” Deputy Transport Minister Le Dinh Tho told VIR.

According to Thomas Treutler, partner and managing director of Tilleke & Gibbins Consultants Limited, foreign investors will certainly be interested in investing in well-established airlines. Travel to Vietnam for business and tourism will continue to rise, as will outbound travel for Vietnamese businesses reaching out internationally to investors and Vietnamese citizens travelling internationally for tourism.

“Domestic travel within the country is also booming, with more affordability. Thus, it certainly has the potential for continued development and can be a lucrative investment,” Treutler said.

ACV and VNA are quite appealing to foreign investors, both having demonstrated solid performance in 2016.

ACV – the operator of 22 airports across the country – made a net revenue of VND13.4 trillion ($609 million) last year, up 23 per cent on-year, while its pre-tax profits rose 58 per cent on-year to over VND4 trillion ($181.8 million).

VNA – which holds a 42 per cent market share in the domestic airline sector – reaped consolidated revenue of VND76 trillion ($3.45 billion) last year, up 10 per cent on-year. It also achieved record-high consolidated pre-tax profits, raking in VND2.5 trillion ($113.6 million), up 140 per cent on-year.

The two groups are also planning ambitious future investments to increase operational efficiency. Specifically, the Hanoi-based carrier has decided to invest a large sum to increase its fleet from 93 to 120 aircraft by 2020. It is also set on maintaining its annual growth of 16.1 per cent during the next three years.

The robust performance and future potential of the aviation industry has made it very attractive to foreign investors compared to other forms of transportation.

According to the Civil Aviation Administration of Vietnam (CAAV), Vietnam’s aviation industry, which contributes $6 billion to the country’s GDP annually, grew 29 per cent on-year in terms of passengers in 2016.

In addition, Vietnam’s passenger:population ratio is less than 1:1, compared to rates of 4:1 or 5:1 in more developed markets like Singapore, Hong Kong, and the US. Thus there is plenty of room for future growth.

“Foreign investors often target large-scale firms and firms that are in the same business field as they are. VNA and ACV are good examples of past targets,” said another senior official in the Ministry of Transport.

In 2016, the stake sales by VNA and ACV were among the hottest in the aviation industry, as many multi-national corporations lined up to take part in the auctions.

Paris Aéroport, which manages 37 airports, outbid rivals including Singapore’s Changi Airport International, and Japanese investors Taisei and JATCO to become ACV’s strategic foreign investor.

Also last year, VNA gained a valuable partner when ANA Holdings – Japan’s largest airline – bought an 8.8 per cent stake in the state-owned firm for VND2.38 trillion ($108 million).

VIR